You REALLY need to focus your marketing on influencing CLV (Customer Lifetime Value), and you need to know this one piece of crucial insight to know why.

Lifetime value is often avoided as a vital metric, because its name suggests something about it taking years – literally a lifetime. And let’s face it, with the typical tenure of a PE fund being less than 5 years and a leadership team often being about a 1/3 – 1/2 of that, who has time for that?

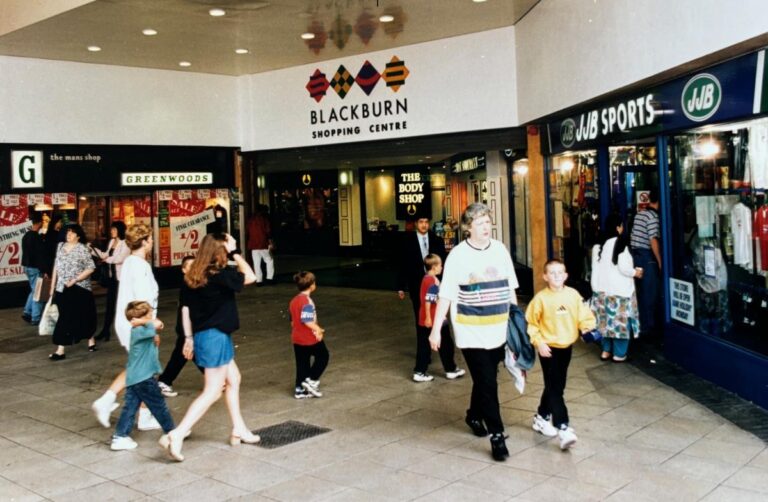

But that’s because you don’t know how short a customer lifetime with you ACTUALLY is. For retail the average is 12-24 months and for hospitality, only 6-18 months.

Meaning, you have a very short window indeed to get the maximum value from your customer base before a weak experience, or better comms from your competitors steal them away.

OUR ENTIRE PROPOSITION IS BASED AROUND CLV

We believe in CLV so much, we’ve rebuilt our entire proposition around it. Why?

- Forget vanity metrics like database size or open rates, CLV is the TRUE indicator of loyalty and brand health. A low CLV suggests you might be already on a downward trajectory.

- When you know your CLV, you can stop pouring cash into ineffective new customer acquisition, focusing instead on a super segment of those who are likely to spend the most with you and nurturing them accordingly – thus reducing a shit ton of marketing waste.

- CLV is one of the strongest predictors of how customers are likely to spend with you over the coming 12 months. If you know your CLV, you can take action to change it, potentially changing the future of your business

Drop me a line to book a 30 minute discovery call, and let’s start driving the metrics that matter!